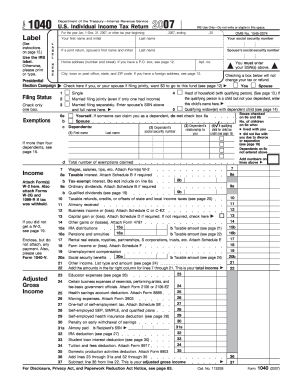

Step 2: Enter required dataĮnter your name and Social Security number on line 1. You can download this form from the IRS website. The only way you can obtain copies of your tax return from the IRS is by filing Form 4506 with the IRS. If you used TurboTax Online, you can log in and print copies of your tax return for free.

If you filed your taxes with a TurboTax CD/download product, your tax return should be stored on your computer, so you can print a copy at any time. Once the IRS receives your request, it can take up to 60 days for the agency to process it. You can request copies by preparing Form 4506 and attaching payment of $43 for each one. Employees must contact University Human Resources (UHR) to update their SSN.The Internal Revenue Service (IRS) can provide you with copies of your tax return from the most recent seven tax years.Rutgers Biomedical and Health Sciences (RBHS) Students can update their SSN using this form.Rutgers Legacy Students can update their SSN using this form.Students who are missing or have an incorrect social security number (SSN) on file must complete and submit a W-9s form. Information Reported on the 1098-T Formīox 1: Total amount of qualified tuition and fees payments received.īox 2: No longer in use per 2018 IRS requirements leave blank.īox 3: Shows that the university changed its reporting methods for tax year 2018.īox 4: Adjustments made for the prior year.īox 5: Total amount of all scholarships/grants received.īox 6: Adjustments made to scholarships/grants for the prior year.īox 8: Enrollment status (full-time or half-time). Then, select 'Tax Notification' and type the tax year you wish to view, and hit submit. Log on to your myRutgers dashboard with your net ID and password.Ĥ.

Visit the IRS Tax Benefits for Education Information Center for more information. Learn how tax credits, deductions, and savings plans can help students with their expenses for higher education.

Rutgers also provides student account information to help you to file your federal tax returns and to apply for education tax benefits. Students will be notified by email when the 1098-T tax form becomes available online for download.Ĭlick here to download your 1098-T Tuition Payments Statement form. This information is provided on the 1098-T, Tuition Statement form.ġ098-T tax forms will be made available no later than January 31st of each year. Under the provision of the Taxpayer Relief Act of 1999, Rutgers, The State University of New Jersey, is required to report certain information about your status as a student to the IRS.

0 kommentar(er)

0 kommentar(er)